We have already covered budget planners, let’s talk about the personal finance today. It’s so important to have a clear idea of your finances in order to make smart money decisions.

Ask this question to yourself “how aware are you about your current financial condition?”. It’s easy to feel lost when you have no idea how much you owe, what you own, and what’s your monthly cash flow. You don’t have to be accounts expert in order to get your personal finance right.

With right tools and strategies you can easily get aware of your financial condition and fix it if needed. We advise all people to use a personal finance statement template because that gives you a snapshot of your finances at a glance.

A personal finance statement template is easy to use, you can ace it easily even if you are not good with numbers. So let’s get started!

Contents

Understanding Personal Finance Statement

A personal finance statement gives you an overview of your financial situation for a particular point in time. It states the following:

- your assets (property you own),

- your liabilities (your debts and other obligations),

- and your net worth (the difference between the two)

Through a personal finance statement, you get to know how the money is flowing in and out i.e. you can see a breakdown of your income, spendings, savings, etc.

When do I need personal finance statement?

There could be number of instances where you may need to prepare a personal finance statement, some of the reasons are listed below:

- maybe for a bank loan

- maybe your kids are applying for a passport or admission

- maybe you’re going into new business venture

- or you just need it to how an idea of your personal financial health

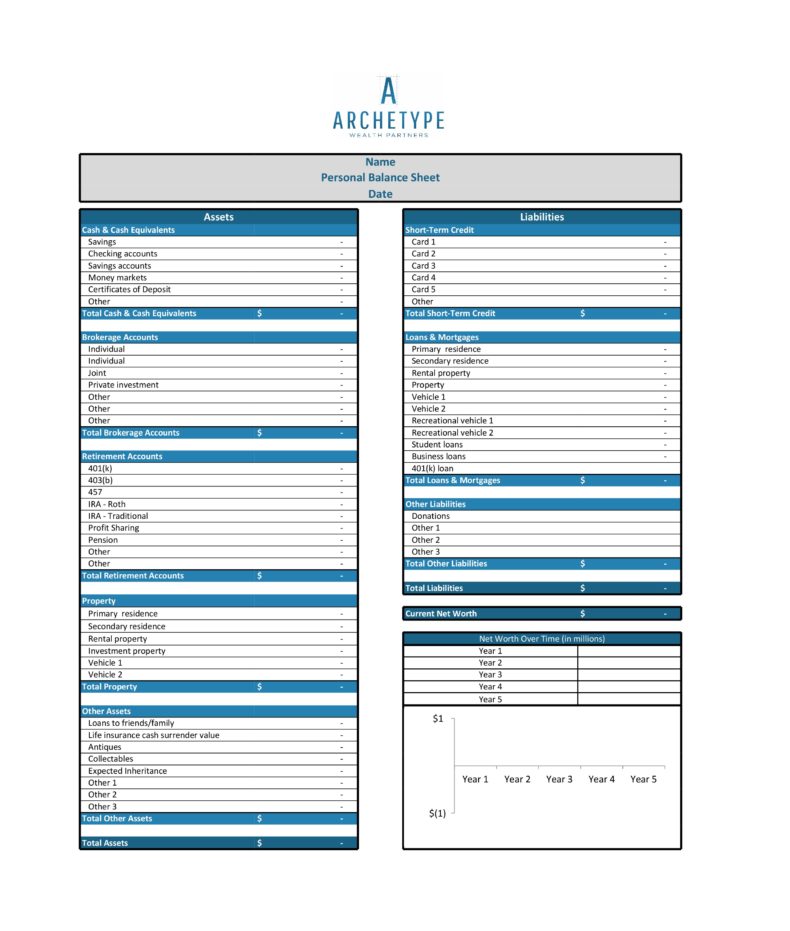

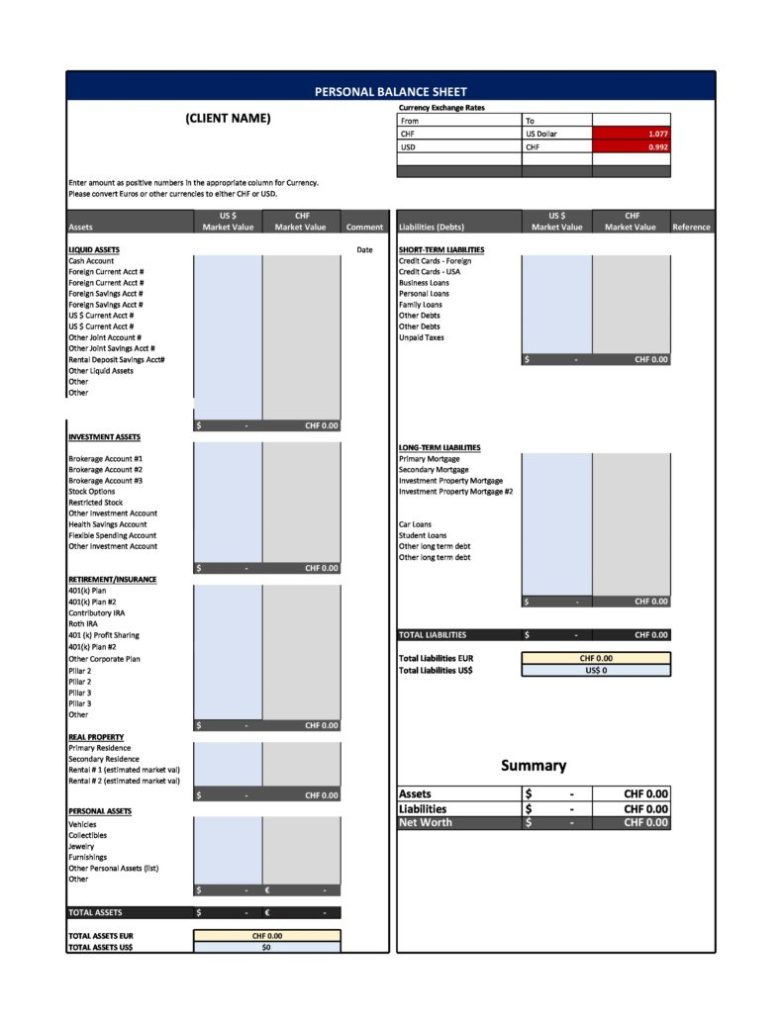

How does a Personal Financial Statement Looks Like?

Here is the most simplest explanation of how does a personal finance statement works:

1. Assets (Everything You Own)

| Category | Description | Estimated Value ($) |

| Cash & Bank Balance | All your bank accounts | |

| Investments | Stocks, mutual funds, SIPs | |

| Property | House, land, apartment | |

| Vehicles | Car, bike, scooter | |

| Retirement Savings | PPF, EPF, NPS, etc. | |

| Valuables | Jewelry, gadgets, etc. | |

| Total Assets |

2. Liabilities (Everything You Owe)

| Category | Description | Amount ($) |

| Credit Card Bills | Outstanding balances | |

| Personal Loans | From banks or lenders | |

| Home Loan | Remaining EMIs | |

| Vehicle Loan | Car or bike loan | |

| Education Loan | Student loan | |

| Other Liabilities | Anything else you’ve borrowed | |

| Total Liabilities |

3. Net Worth (Your Financial Scorecard)

Net Worth = Total Assets – Total Liabilities

| Description | Amount ($) |

| Total Assets | |

| Total Liabilities | |

| Net Worth |

A Real-Life Example

Let’s take an Example of “Sarah” and she wants to purchase a new car but not sure whether she can afford it or now. She prepares a personal finance statement for herself and find out:

- Assets: $48,000 (cash as well as investments)

- Liabilities: $21,000 (credit card as well as a student loan)

- Net Worth: $48,000 – $21,000 = $27,000

- Monthly income: $4,500

- Monthly expenses: $2,700

- Monthly Savings: $1,800

Now Sarah has a clear understanding of her financial health so she can make a decision which car she can afford.

Download Personal Financial Statement Template

Personal Balance Sheet Template in Excel

Here is quick informative video to help you create a personal financial statement:

How to manage money on Payday | Income, Expenses, Savings

Understanding how to manage your money and how to control your money is one of the most important life skills that every person should master.

It does not matter whether you’re earning $50,000 a year or $100,000 a year. What matters the most is how you manage that money.

Learn to Make the Most of the Money you have. Always aim to find a perfect balance between living in the moment and planning for the future.

Defining the 3Fs for Money Management

Before defining the 3Fs, first you need to first how much money you are actually making each month. This is the amount that lands in your bank after tax. If you have multiple income sources then make sure to include all of them i.e. it could be your permanent job, freelancing income, dividends, etc.

Now you have your total monthly income, so let’s define the 3Fs

- Fundamentals

- Fun

- Future

Here Fundamentals are your essential needs, you cannot negotiate on these. It includes food, transportation, insurance, mortgage, utilities, etc.

Fun are the joys of life i.e. eating out, going out, traveling, clothing, entertainment, etc.

And Future things are emergency fund, education, house fund, retirement, etc.

Follow the 50 | 30 | 20 Rule

which says that 50% of your monthly income should go the Fundamental bucket, 30% should go to the “Fun” bucket, and 20% should go to the “Future” bucket. You can obviously adjust the percentage as per you life circumstances.

Money management is no rocket science, you can do it easily if you basics are clear and you’re dedicated person. I personally use this 50 | 30 | 20 Money Management Rule.

FAQs

Q. Is a personal financial statement the same as a budget?

A. No, A personal financial statement gives your current financial position while a budgeting means planing your income and expenses. It’s important to pay attention to both in order to improve your finances.

Q. Do I need a financial advisor to create personal finance statement?

A. You can create a finance statement easily using an excel or Google Sheets. There are many online tools that can be used to do the same. You won’t have to necessarily work with a financial advisor unless you don’t want to do it by yourself.

Q. What counts as an asset and liability?

A. Assets may include Cash & savings, Investments (stocks, mutual funds, retirement accounts), Property (home, car), Valuable personal items (jewelry, art) and Common liabilities include Credit card debt, Student loans, Auto loans, Mortgage, Personal loans, etc.

Q. How do I calculate my net worth?

A. The formula to calculate your net worth is Net Worth = Total Assets – Total Liabilities. Let’s understand it with an example, If your assets are worth $100,000 and liabilities are $60,000, your net worth is $40,000.