Budget planning template is one of the most essential tools that every person must have. Managing finances can be a bit overwhelming many a times specially when you have multiple expenses and saving goals. A budget planner is used for the financial management. Personally, I used to struggle a lot managing my expenses and savings. Budget planner is a saviour for those who have financial goals and who want to organize their expenses and saving in a structured manner.

A variety of budget tracker templates are covered in this post. We have a templates for both beginners and advanced financial planners. Financial planning is a skill that every person must learn and master in order make better and informed financial decisions.

Contents

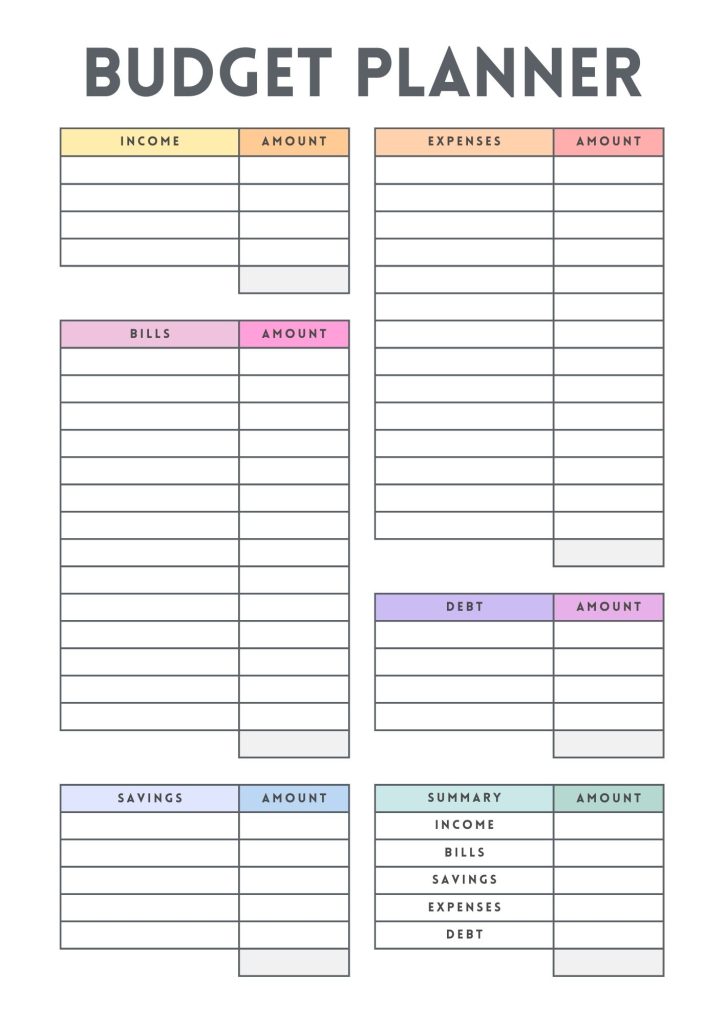

Printable Budget Planner Template

I’ve been using this budget planner for many years now. It has all the elements that you need in a good planner. Let’s briefly understand the different elements of this planner for an easy understanding of people.

- Income: Mention your incomes sources and amount.

- Bills: Write down the bills you are required to pay monthly, i.e. electricity bill, water bill, mobile recharge bill, internet subscriptions etc.

- Expenses: Write down the monthly expenses and their amount.

- Debt: If you have any debt or EMIs then include them here.

- Savings: You must save money every month.

- Summary: Here comes the summary of the budget planner for a month.

What is a Budget Tracker Template?

For all those who are unaware of what Budget Tracker Template is, here is quick definition, A budget planner is a well structured document or tool that is designed to help people monitor their income and expenses over a period of time. Use may use a budget planner to manage your personal finance, business expenses, even expenses, etc. A budget planner can be customized to an individual needs or requirements.

Following are the basic elements you may see in a budget planner:

- Income: Here you can mention the income sources i.e. salary, business, investments, etc.

- Fixed Expenses: For each month, you will have a variety of fixed expenses such as rent, utilities, insurances, etc.

- Variable Expenses: There will be many variable expenses such as travel, grocery, entertainment, etc.

- Savings: You must have monthly saving goals for yourself.

- Debt payments: Here you can mention the details related to any loan or credit card payment you have.

Budget or financial planning is not limited to professional and businesses only. A school going student can use a budget planner to manage his or her finances. The early you start, the better it is. In fact parents or families should teach their kids the value of financial management.

Free Budget Tracker Template

This budget tracker is simple and straight forward. There is one column for incomes and the another column for expenses. So what are you waiting for? Download it, print it, and start filling it. Take charge of your finances by using a budget planner or tracker template.

Why Should I Use a Budget Tracker Template

Are there any benefits of using a budget planner? Why should i use it? Why should I spend time in filling this planner? These are some of the questions I’ve had and I’m sure many of you also feels the same. Budget planning is not taught to use, even though it’s one of the most essential life skills.

Here are some of the reasons why everyone should use a budget tracker template:

Financial Awareness

Most of us don’t have a clear idea from where our money is coming and where it’s going. A budget tracker makes you aware of your monthly expenses, you get to see where you’re overspending money and where you can save more. Better financial awareness comes with a budget tracker.

Improve Savings

Once you have a clear idea of your expenses, you can plan better for savings. A budget tracker is used to plan savings, your goals should be to attain the financial freedom as soon as you can. Make sure to be realistic while planning savings.

Fix Spending Habits

We often spend a lot of money on things which are not adding any value in our life and the worst part is that we are not even aware of it. A budget tracker let you know where exactly you’re spending, so you can make informed decisions on your spending habits.

More Financial Control

When you have a well structured financial planner, you’re more in control of your finances and there is less stress. Make sure to thoroughly check the planner every month to remove any unwanted expenses.

Sharing my personal experience, I used to spend a lot of money ordering food from outside and I’ve noticed it until I started using a budget tracker. I’m sure there must be a lot of things which you’re not aware about your spending habit, use a budget tracker to control your finances in a better way.

Quick Tips for you all Budget planners

- You need to update your tracker on a daily or weekly basis for maximum accuracy.

- Make sure to have an emergency fund in your bank account to take care of unexpected expenses.

- If you’re managing a family budget then share a planner with them to make them informed.

- Make sure to review your budget planner at the end of every month to see the areas where improvements can be made.

Final Words

Financial freedom comes with smart budget planning. Earning money is one thing and utilizing money is another thing. I know a lot of people who earns very good but their savings are nothing because they don’t have control over their spending habits. Be an organized person who is well aware of this expenses and saving. A budget tracker template should be there with you.

A variety of budget planners are shared here, use any of the planner and start making informed financial decisions. We do have a lot of important planners and calendars on this website, do check them out as well. Happy planning!