Business budgeting is extremely important for all businesses whether it’s a small business or a big organization. You will be shocked to know the result of a survey which says “approximately 60% of small businesses have not created a formal budget”. There is a huge percentage of small businesses which are operating without a formal business budget and it’s a big blunder. Without a business budget, you may not understand how your business is actually performing and you won’t be able to make informed financial decisions.

A business budget is a necessity of each business to understand how much money is there, how much to spent, and how much to save for future. Through a budget, you’re able to make informed business decisions such as cut down on unwanted expenses, increase man power, purchase new equipments, right time to scale, etc. A business budget guides on what to do next. If you have insufficient money then you need to change your business plan and spend more wisely.

Every business specially small ones are required to create a business budget in order to keep a track of income and expenses. Making informed financial decisions is possible once you have a budget in front of you. A right budgeting plan helps your business out of debt or find ways to reduce the debt it is currently facing.

In this page, we have talked about the importance of a business budget, how to create it, and few free budget templates are shared in an editable format.

Contents

How does a business budget work?

If you are running a business or planning to start one then make sure to educate yourself about business budget, how does it work, what are the benefits, and how to make informed decisions using a business budget.

Running a business is not everyone’s cup of tea. You may start it easily but running it profitable consistently is a huge challenge. Budgeting is a part of every business and you have to do it right in order to operate profitably.

Now let’s understand how does a business budget works:

You create a business budget for each month i.e. keep a track of income and expenses for each month. The past months data or numbers are used to make financial decisions for the current month and for upcoming months. For an instance, let’s say you have a bad three months and you can predict another one or two months will be slower then in such a case you should focus on minimize the expenses where possible.

Now let’s say your business is doing great from the past few months, sales are booming then in such a case you should focus on buying more inventory and scale up your business.

All these financial decisions are taken once you have business budget in front of you for each month. So make sure to create a business budget for your business and make informed decisions.

Now the question comes, how to create a business budget?

Creating a business budget from scratch is a lot of work and time consuming. These days, a variety of tools and software are available which do the work for you. If you are a small business and you may not have a budget for those paid tools then you can use a business budget template.

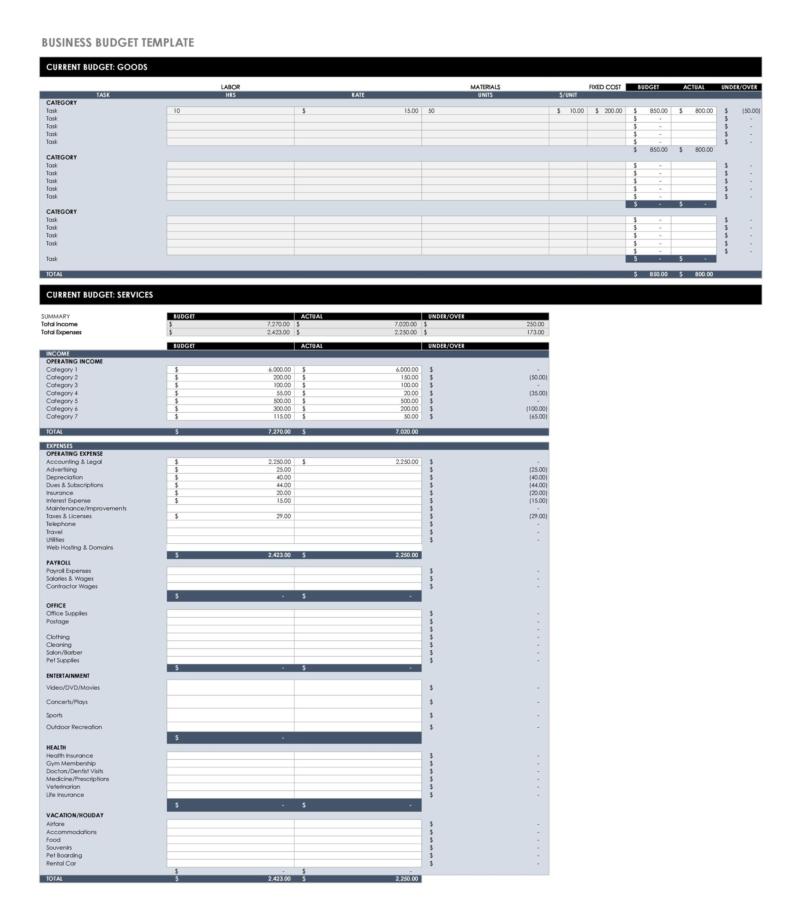

This is how a business budget template looks like:

Template Source: https://templatelab.com/

This is a great template for small businesses. Following are the elements of this template:

- Core Income

- Other Income

- Supplies

- Rent/ Lease

- Utilities

- Total Income

- Total Expenses

- Profit

Different types of budgets

Let’s understand different type of budgets briefly so you have an idea of how many type are there:

Master Budget: A master budget is created by taking inputs from financial statements, the cash forecast, and the financial plan. The purpose of creating a master budget is to plan business activities for the accomplishment of business goals or objectives.

Operating Budget: An operating budget is kind of a profit and loss report i.e. it shows business’s projected revenue and the expenses associated with it for a period of time. This budget is usually prepared at the beginning of each financial year and you may update it whenever required.

Cash Budget: This one tells how much money is coming into the business and how much is going out for a specific period of time. Through a cash budget, you get to know how much liquid cash you have for operating.

Financial Budget: Each business has it’s short term and long term needs. A financial budget is created to understand how much capital is needed to fullfil those needs. This gives an idea of business overall health.

Labor Budget: Each business needs to hire employees in order to accomplish their goals. A labor budget helps you understand how much workforce you need and what will be the payroll for them.

Benefits of Creating a Business Budget

There are many small businesses who never created a business budget. Here are some of the reasons why every business should create a business budget:

- Through a business budget, you get to know how your business has performed and how it’s looking to perform over the next months.

- Creating a financial plan is possible once you have a business budget with you.

- If there are leftover funds then you may reinvest them.

- You can estimate what it will take to become profitable

- You can predict the slower months and prepare accordingly.

- You will have a better idea of what to do next.

Managing a business is smooth once you have a well structured business budget with you. With the help of business budget, you will be spending money in the right direction to ensure you’re out of debt and running profitably.

Download Business Budget Templates