We’ve already covered business budget template for businesses, now let’s talk about Financial Projection in this post. If you’re running a business then you must already known what a financial projection is and if you don’t know what it is then here is the definition,

“A financial projection is basically an estimate of a company’s financial performance. A financial projection is created by businesses in order to forecast revenue, expenses, cash flows, etc. The financial projection is created using the past financial records of a business”

Every person who is running a business or planning to start one must understand the importance of financial budgeting and financials projection. The financials of a business decides whether you’re running a business profitably or not. Plan your finances very carefully to ensure you are not wasting any money. Use a financial projection template to project the financials over a specific period of time i.e. 12 month financial projection, 3 year financial projection, 5 year financial projection, etc.

If you are looking to create a financial projection for your business then we got you covered. For the convenience of out users, we have shared the FREE financial projection templates here.

Contents

Who needs to create a financial projection?

- All those people who are running a business must learn to create or understand a financial projection.

- If you are planning to start a new business then make sure to educate yourself about financial projection and learn to create one.

- If you are someone working in finance department then you must have a knowledge to create a financial projection.

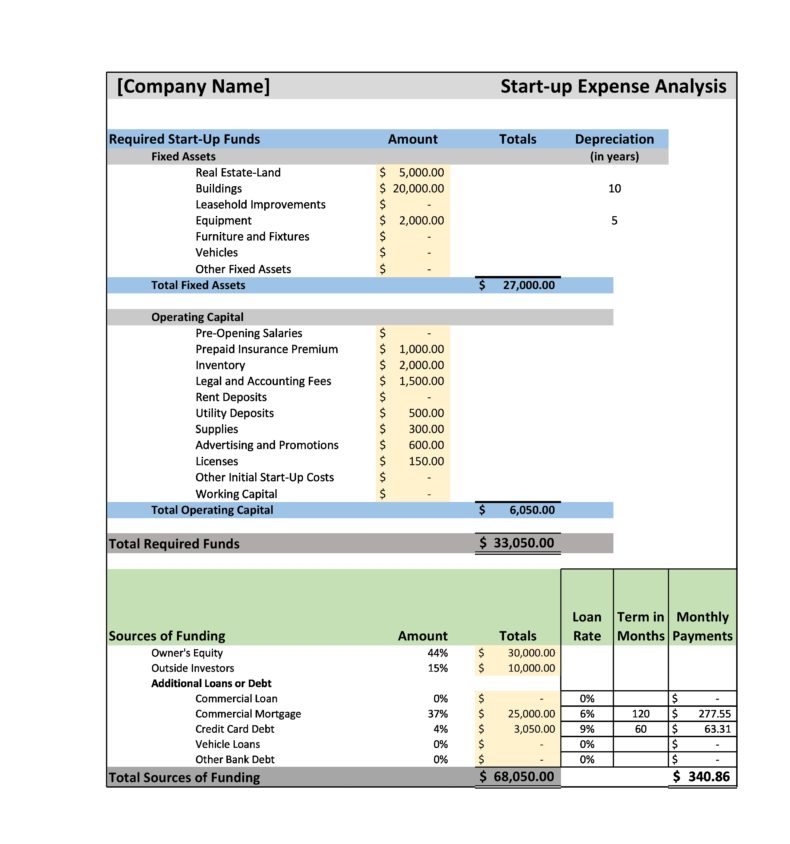

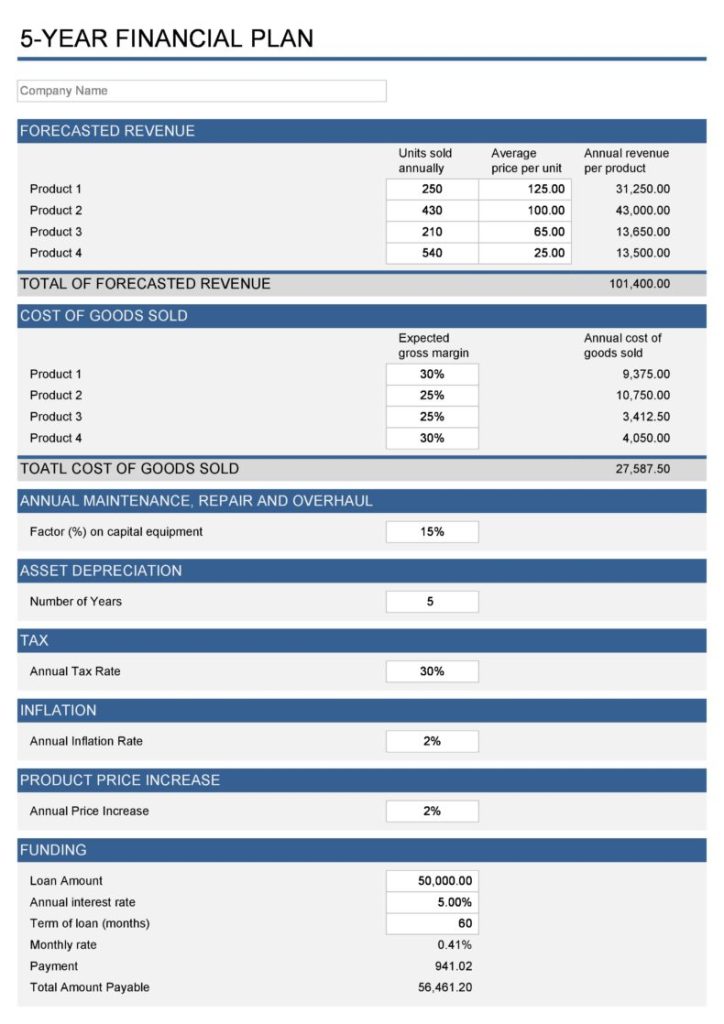

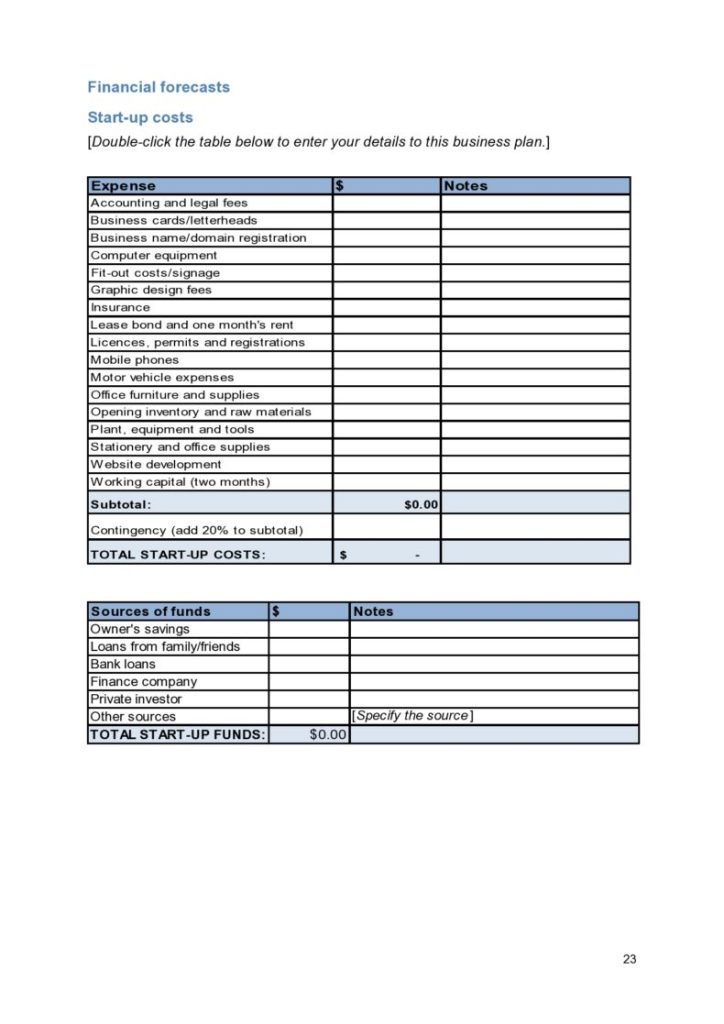

Preview of Financial Projection Template

This is how a Financial Projection Template looks like, there are a different type of templates available depending on the type of business.

Following are the common elements of a Financial Projection Template:

Income Statement, this is also known as profit and loss statement. It is important to keep a check on the income statement to find out the status of a business profitability.

Cash Flow Statement: Through this statement, you get to know how much money goes in and out of your business in the form of either expense or income. Operating Activities, Investing Activities, Financing Activities, etc are included in it.

Balance Sheet: Through a balance sheet, you get to know the general financial health of a business. Assets, Liabilities, Owner’s Equity, etc are covered in balance sheet.

Famous Methods for Financial Forecasting

Let’s understand different methods which are used by businesses for financial forecasting,

Straight Line

In this method, the company’s historical growth rate is assumed to be remain constant. The future revenue is projected by multiplying a company’s previous year’s revenue by its growth rate. Let’s say that a company’s previous year growth was 10% then straight-line forecasting assumes it’ll continue to grow by 10 percent next year.

This method does not take fluctuations or issues into consideration. You may use this method as a starting point.

Moving Average

This method is beneficial when it comes to short term forecasting i.e. you may use it to predict next month or next quarter sales. Here is how it works,

In this method, you take the average or weighted average of previous periods to forecast the future. The formula is,

Formula: A1 + A2 + A3 … / N

Formula breakdown:

- A = Average for a period

- N = Total number of periods

Market Research

Market Research is great for startups and organizational planning. The entire market view is taken based on competition, fluctuating conditions, and consumer patterns, etc. In order to understand the consumer behaviour, you may need to send surveys to them in order to get some data to make informed decisions.

Download Financial Projection Templates

Why Should I Use a Template?

Creating a financial projection from scratch may consume a lot of time and efforts. This document is basically created by professionals who have a understanding of business financials.

While creating a financial projection, the existing financial information or records are used in order to forecast the future expenses and income of your business. Different scenarios are taken into consideration while creating this document because the business faces challenges from time to time that may affect the profitability of a business.

Using a financial business projections template is one of the most convenient and effective ways to create a projection document.