Credit Card is one of the most used financial tool, There are approximately 166 million credit card holders in the U.S and the average American hold about 3 credit card. These numbers shows how widely used credit card in the U.S. Not just U.S, the credit card is widely used all over the world because of its easy of use.

People often used credit card to pay their bills, shopping, order food, book ticket, hotel booking, etc. Using a credit card is one of the most convenient ways to make a payment in today’s time. But the questions is, Are credit card transactions always secured?

A plenty of credit card frauds are happening these days which makes it important to secure your credit card so there is no misuse of it. Securing a credit card is very important and this is where Credit Card Authorization Form comes in handy.

Contents

What is a Credit Card Authorization Form?

“A credit card authorization form is a formal official document that is signed by a cardholder (customer) to grant a permission to the merchant (business) to charge their credit card for a certain amount for one time, monthly, quarterly, yearly, etc even if the cardholder is not physically available”

The CC Authorization Form secure both businesses and the cardholders.

No more unauthorized transactions for cardholder

- Only the authorized transactions will happen for which the cardholder has given permission. There won’t be any unauthorized transaction. Even if the authorized one happen, then you have a signed form with you to request a chargeback.

No More Chargebacks for Businesses

- The credit card authorization form is beneficial for businesses because it avoid chargeback.

A chargeback happen when a cardholder disagree with the charge that is deducted by the business. The cardholder may ask the credit card issuer to reverse the transaction. This whole process is very daunting and time consuming for businesses.

A CC authorization form acts as a proof for a business to show that the cardholder has given the permission to charge the card for a certain amount for a specific period of time.

It’s a legal document so it should be prepared accordingly. The signed form helps businesses from any unnecessary chargebacks and it prevent customers from having any unautorized transaction.

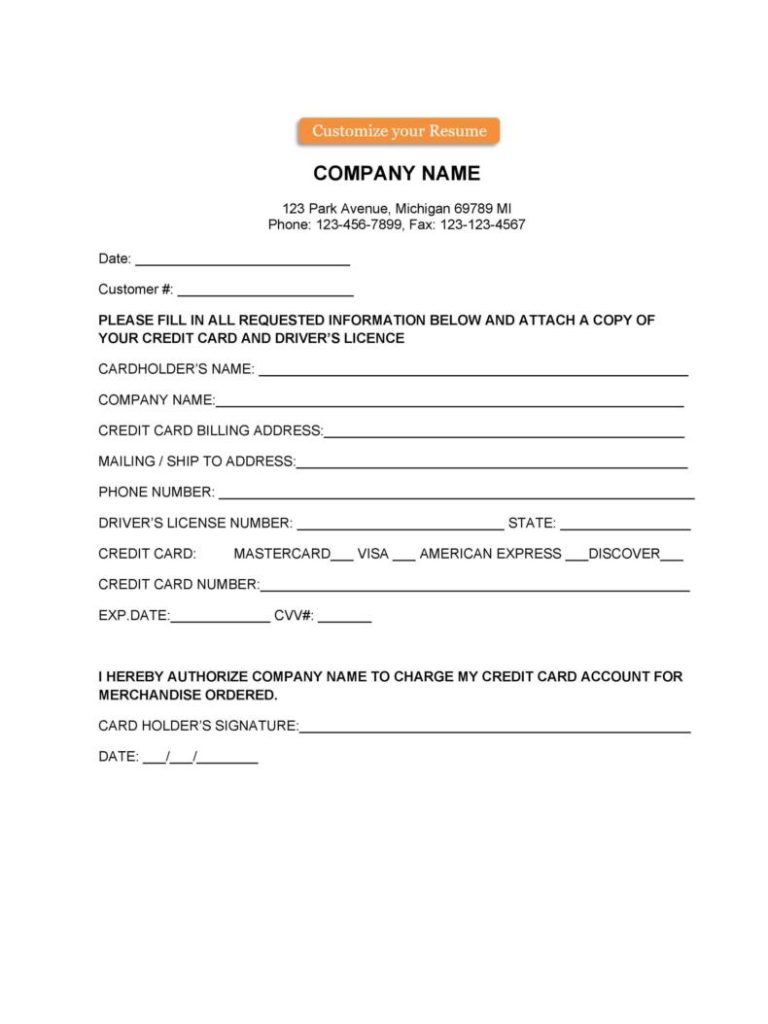

The format of this form may vary from business to business but this form should not be very complicated. Keep it simple and concise. Following are some of the basic elements that you can find in every credit card authorization form:

- Cardholder Details: The full name, billing address, and contact information of the cardholder should be there.

- Credit Card Details: The credit card details should be included such as type of card, credit card number, expiry date, and the CVV or the security code.

- Merchant or business information: The name, address, and contact information of the business should be included.

- Authorization Statement: This is the whole reason why this form is created so make sure to write down a strong authorization statement which will give authorization to a business. Make sure to state very clearly about the type of transaction, amount, single or recurring, if recurring then for how many months or years. The cardholder should read this statement very carefully and sign only if you agrees to it.

- Signature of the cardholder: A form without signature is just a piece of paper. It’s the signature which makes it valid. If the cardholder agrees with the details then he should sign and date it.

Understanding 3 Common Types of Credit Card Authorization Forms with Templates

- Standard Credit Card Authorization Form

This one is pretty simple and basic, it’s universally accepted. You can use this template for a variety of transactions, this one is most commonly used by businesses because it’s accepted worldwide. Use it for a variety of purchases.

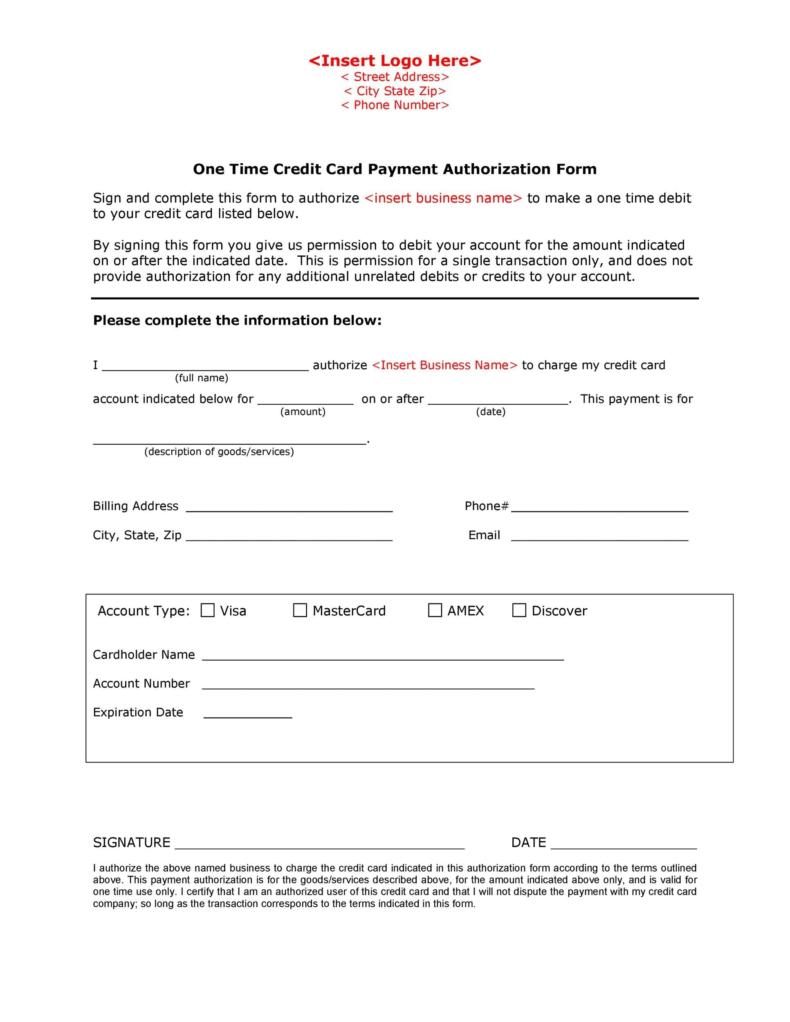

- One-Time Credit Card Authorization Payment Form

Use this template if you allow only one time transaction. This one is also pretty simple and straightforward. This is used for transactions which can happens only once.

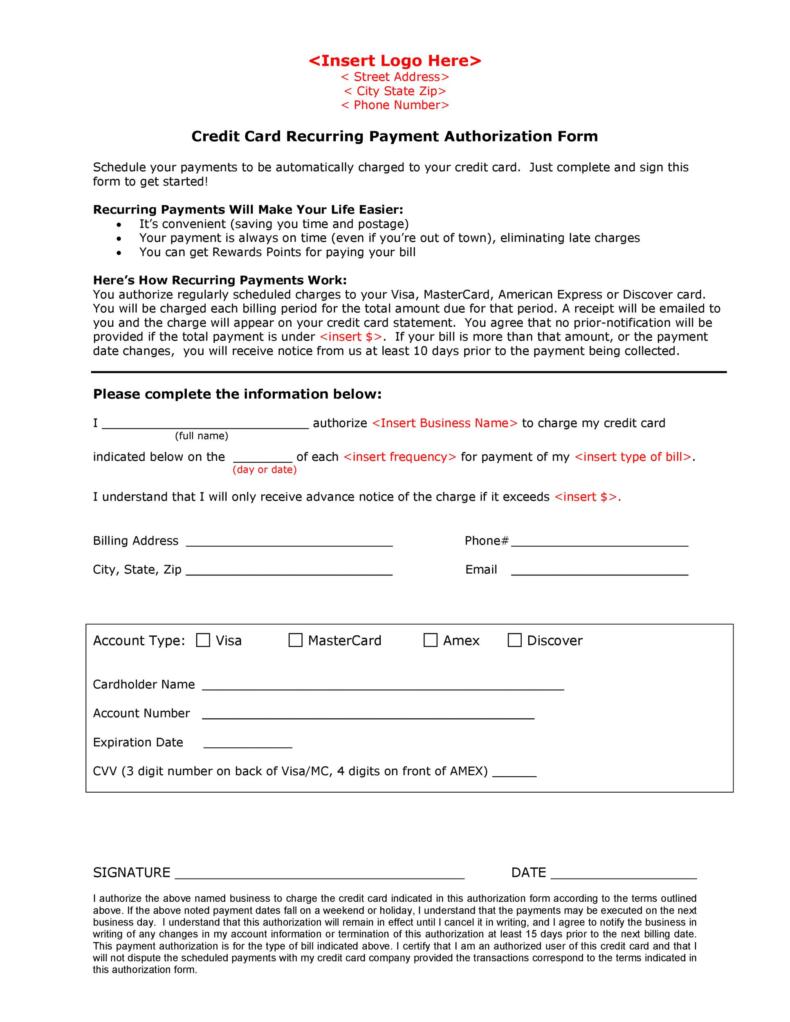

- Recurring Payment Credit Card Authorization Form

This one is more detailed than the templates that we’ve discussed above. This template can be used for a recurring payment. As a business, you must specify to the customer that this form is for recurring payments so he or she can understand it accordingly. In this form, you need to mention the total number of charges, amount of each charge. Mention whether the charges will be deducted monthly, quarterly, or yearly.

As a carholder or customer, you must verify what type of form is used. I mean, you can fill up a recurring form for a one time payment. So always check which form is being using by a business. And as a business, it is your responsibility to explain everything to the customer, do not hide any details, just be upfront and honest about everything.

Give or Obtain Legal Permission to Charge a Card

By signing the cc authorization form, the cardholder give consent to a business to charge a credit card for a certain amount for a specific period of time. With this signed agreement, the customer cannot file for a chargeback and business cannot charge an amount beyond what’s specified in a form.

Prevent Credit Card Fraud

The authorization form actually protects both the business and customer from any unauthorized or disputed transaction. Credit card frauds are common these days. We advise all cardholders to secure their credit card details and do not share them with any business without signing an authorization form.

Easy & Secure Payments

The recurring payments for goods or services can be made very easily and securely. Making recurring payment is a daunting task specially for those who are bad with remembering dates.

Serve as a Proof

A cc authorization form can be used as a proof in case if there is any issues of chargebacks or disputes. It actually secure the rights of both business and customer. Both the parties will be cautious of doing anything wrong once there is a signed official authorization form.

The credit card authorization form is actually beneficial for both the business and customer.

Be Aware of Credit Card Frauds

As per the data available, there are over 800 million credit cards are currently in circulation in the United States which shows about the usage of credit card. With so much usage, there are chances of frauds as well. As a customer and business you should always be aware of such frauds.

Here are some of the common type of credit card frauds:

- Unauthorized Transactions: When the charges are made without the cardholder’s knowledge or consent. This is why have an authorization form in place.

- Phishing Scams: These are very common. Be aware of any fake emails or calls you receive from people who will try to trick you into revealing card information.

- Hacking: If you’re making payments through systems which are not well secured then there is a danger of hackers gaining access to your credit card data.

In order to protect yourself and you business from such scams, you can use a Credit Card Authorization Form, Implement PCI Compliance, Use Secure Payment Gateways, and monitor your transactions on a regular basis.

If you suspect any fraud then immediately contact your bank and ask them to block the card or disable the payment method.

The chances of frauds decrease drastically if you are well informed and proactive.

FAQs

Q. Can I sign the credit card authorization form electronically?

A. The answer is YES, you can sign a credit card authorization form electronically. For electronic signatures, you may use platforms like DocuSign, Adobe Sign, etc.

Q. Is a credit card authorization form legally binding?

A. Yes if the form is well filled out and signed. The whole purpose of having this form is to have a written consent. This can be used as a legal proof in case of disputes or chargebacks. This form secure the legal rights of both customer and business.

Q. Is it mandatory to use an authorization form?

A. It’s advised to have a signed authorization form to avoid the risk of chargebacks, payment disputes, and even compliance violations.

Q. Is Authorization required for Online payments as well?

A. Yes, the consent is required whenever you are making a payment through secure payment gateway (like Stripe or PayPal). It’s advised to collect a signed form as an extra layer of protection specially for large or custom orders.