A bank statement is one of the most important financial documents, every person must know what is a bank statement, how to read or understand it, how to use it, etc. Through a bank statement template, you get to know the account’s debt and credit transactions for a specific period of time.

A bank statement is generated by the bank upon the request of an account holder.

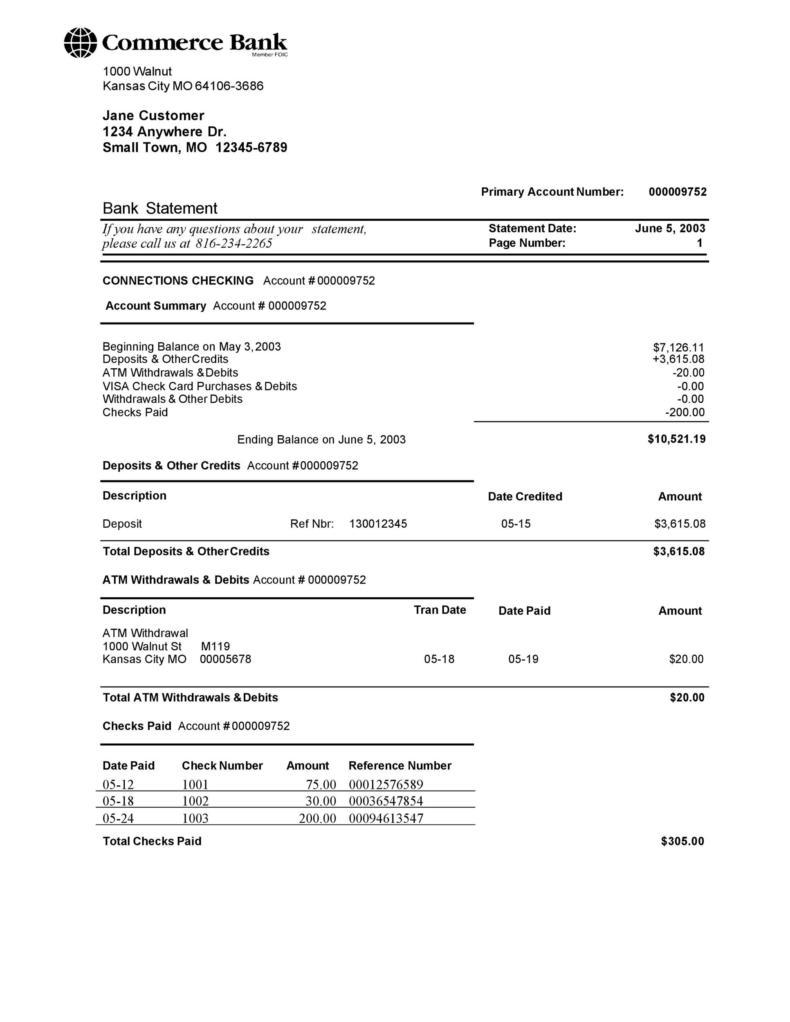

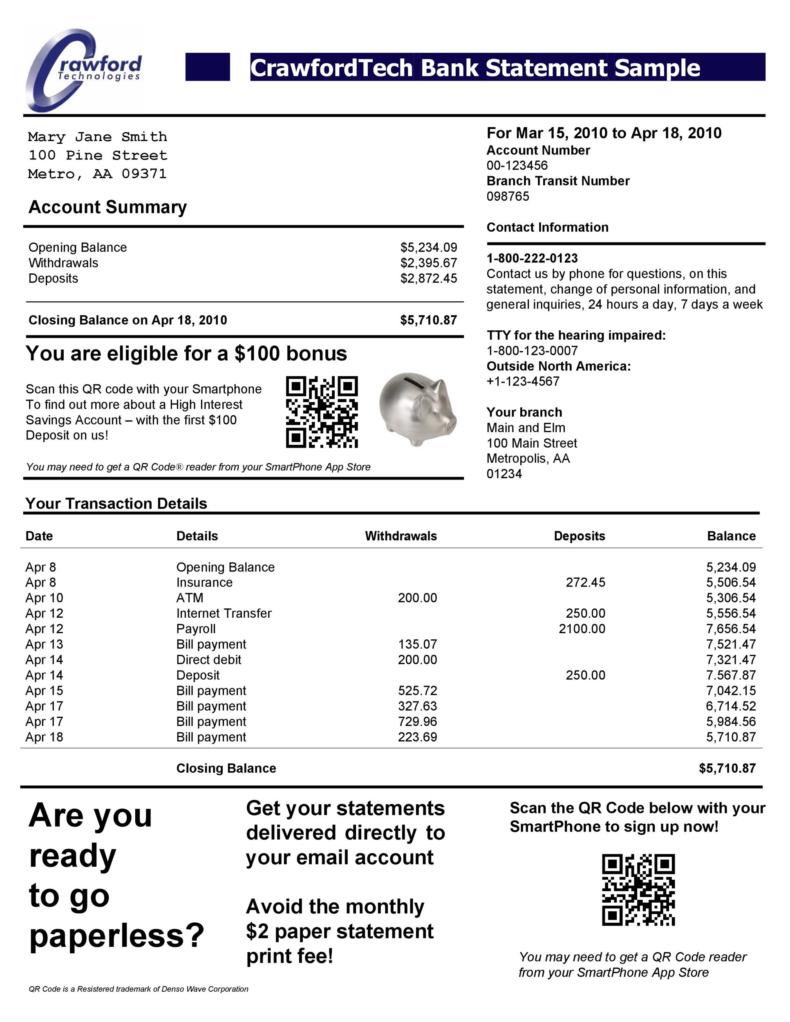

Here is an overview of a bank statement:

- A bank statement gives a list of all transactions for an account over a specific period of time.

- The bank statement includes amount credited, withdrawal amount, charges, etc for a certain time period.

- It is used by people to keep a track of their earning, spending, and expenses.

- You can download a bank statement in digital form i.e. pdf, sheet, etc or print it in a paper document.

Contents

Different Type of Bank Statements

Let’s understand the most common type of bank statements i.e. Electronic Bank Statement and Paper Bank Statement.

Electronic Bank Statement

An Electronic Bank Statement also known a E-Statement is the most used bank statement type in today’s time when everything is online. These days people prefer an electronic statement because they can access in using their mobile device or laptop any time from anywhere in the world.

These days many banks send monthly E statements to their customers via an email. As an account holder, you may download an E Statement using Net Banking or ATMs.

Using a digital document is more convenient in today’s time because everyone has a smart device and internet.

Paper Bank Statement

Paper bank statements are not going anywhere even though there are more convenient options available i.e. E statements. To receive a paper bank statement, you may need to submit a request to your bank and they will provide the paper bank statement. Some banks may charge money to generate paper statement while many banks will do it for free.

There are many people who likes to keep a paper record of their bank statements. You can even download an E statement online and print it for your use.

Where Would I Use a Bank Statement?

At some point in life, you will require a bank statement. Following are some of the instances where you are required to use a bank statement.

- People use monthly bank statements to keep a check on their monthly earning, expenses or spendings. We advise all people to keep a track of their expenses, be aware of your financial situation and plan things accordingly. You will be able to make better financial decisions once you’re aware of your earning and expenses.

- Bank statement could be required while applying for a job. Yes, you heard it right! Many companies ask for a three month or six month bank statement in order to verify the applicant’s salary. If you are applying for a new job then keep a bank statement ready with you.

- You may need a Bank statement while applying for a Mortgage. Many mortgage lenders offers “Bank Statement Mortgage” i.e. they provide loan on the basis of an individual’s bank statement. This type of mortgage is best for self employed people.

- A bank statement is required when you have to give a proof of income i.e. you may need it while applying for a visa, immigration, buying property or renting, etc.

The use of a bank statement is quite diverse. As an individual, you must know how to download a bank statement or how to request your bank to generate one for you.

Different Ways to Download a Bank Statement

If you are wondering how to download a bank statement or how to use it then no worries we got you covered. There are many ways to get a bank statement and most common ones are discussed below,

Download a Bank Statement Online

This is the most common ways to download a bank statement specially in today’s time when everyone has a smart device and an internet connection. A majority of banks have net banking or online banking i.e. people can access their bank accounts through a bank’s app or website.

To download a bank statement online, you need to

- open your bank’s app or website

- login using your credentials i.e. email or phone number and password

- once you’re logged in, find E statement option.

- select the time period for which you want to download the statement

- choose the document format i.e. pdf, etc.

- and download it

That’s it, now you have a bank statement downloaded in your smart device for your selected time period and preferred format.

Visit nearest Bank’s Branch and Request for Bank Statement

To have a paper bank statement, you need to the nearest bank’s branch and request for it. In many banks, you may need to submit an application letter for bank statement.

An application letter is a formal request letter that is written by an account holder to their bank in order to request for a bank statement for a specific period of time. In this letter, it’s required to write down the account holder’s personal details, account number, and the period for which they require the bank statement.

In many banks, you may need to pay a fee to obtain the statement, depending on the bank’s policies. While many banks will do it for free.

Download Editable Bank Statement Template

Check out the bank statement template below to see how a bank statement looks like. You can use these templates for education purposes i.e. understand various elements of a bank statement. These bank statement templates could be used by teacher or parents to teach kids about the use of a bank statement, how to read it, and how to make good financial decisions.

Financial literacy is very important, every person should have a proper track of his or her earning and expenses. Most of us are not aware of our financial situation, this is why start using a bank statement and make yourself financially aware.